how much federal taxes deducted from paycheck nc

Youd pay a total of 685860 in taxes on 50000 of income or 13717. Take Home Pay for 2022.

Payroll Tax What It Is How To Calculate It Bench Accounting

After a few seconds you will be provided with a full breakdown of the tax you are paying.

. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for North Carolina residents only. 12 on the next 29774 357288. Federal Insurance Contributions Act tax FICA 2022.

That rate applies to taxable income which is income minus all qualifying deductions and exemptions as well as any contributions to a retirement plan like a 401k or an IRA. To use our North Carolina Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. 22 on the last 10526 231572.

The next dollar you earn is taxed at 22. The minimum amount we can withhold for. There is a flat income tax rate of 499 which means no matter who you are or how much you make this is the rate that will be deducted.

Social Security Maximum Tax. However 2019 brought an. There will be up to 5000 that will be excluded by the IRS from the pay that your employer diverts into a Dependent Care FSA.

Social Security Compensation Limit. Federal Insurance Contributions Act FICA Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

If the taxpayer is not filing a federal income tax return the taxpayer must complete a schedule showing the computation of federal adjusted gross income and deductions. So the tax year 2021 will start from July 01 2020 to June 30 2021. Money may also be deducted or subtracted from a paycheck to pay for retirement or health benefits.

Total Federal Income Tax Due. Estimated state deductions from federal adjusted gross income 20 of prior bonus depreciation addback. Medical and Dental Expenses.

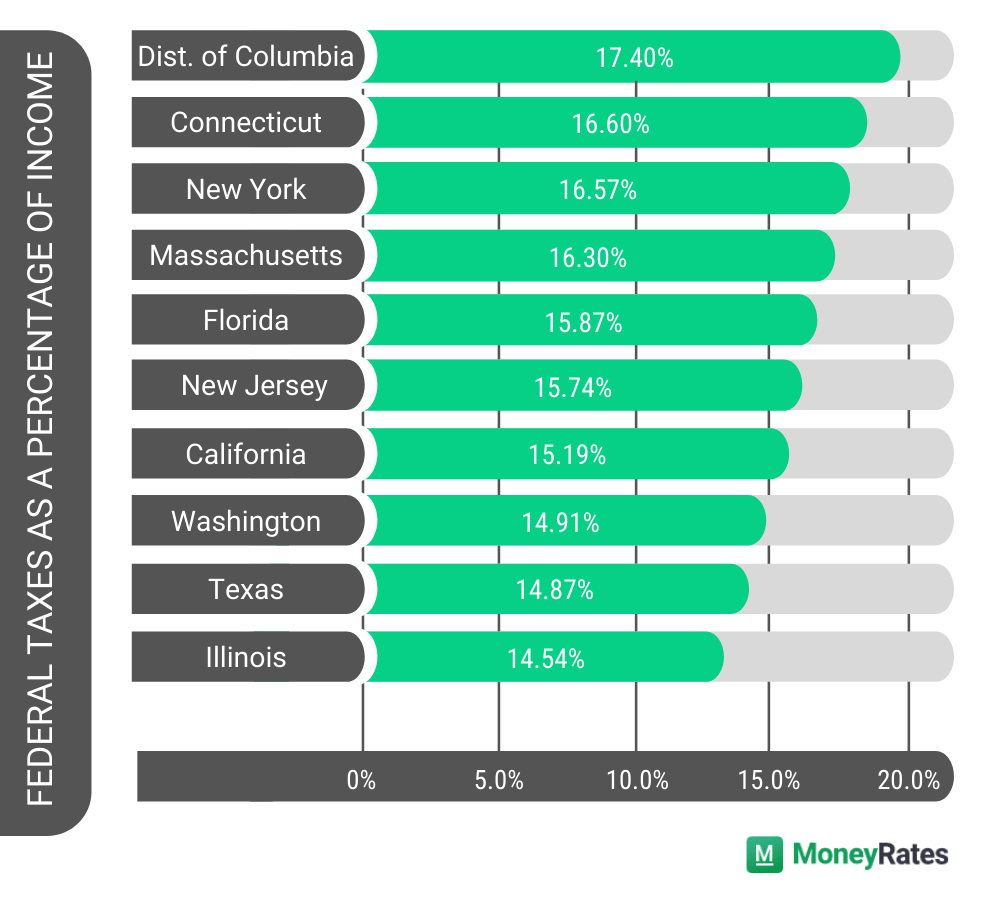

10 on the first 9700 970. Your effective tax rate is just under 14 but you are in the 22 tax bracket. Payroll taxes and income tax.

The new law introduced a single flat rate of 58 and more than doubled the standard deduction for north carolina taxpayers. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you. Social Security Maximum Tax.

North Carolina tax year starts from July 01 the year before to June 30 the current year. That 14 is called your effective tax. 95-258a1 - The employer is required to do so by state or federal law.

Plus to make things even breezier there are no local income taxes. Federal Insurance Contributions Act tax FICA 2022. The amount of money you.

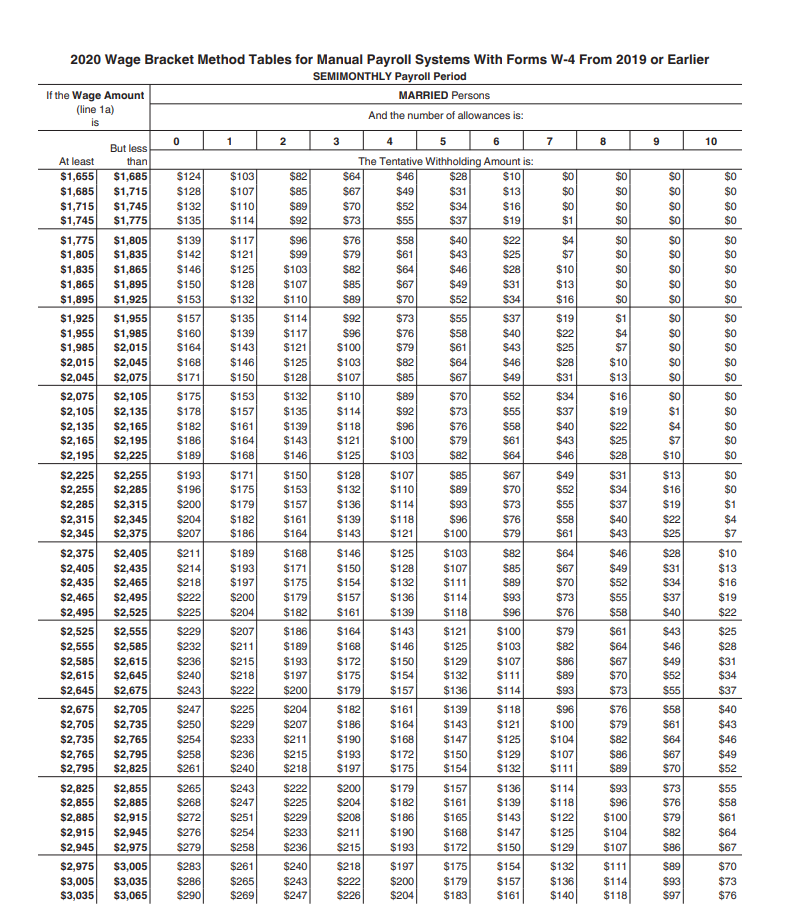

Employer can withhold the correct federal income tax from your pay. For example in the tax year 2020 Social Security tax is. Therefore a taxpayer must determine federal adjusted gross income before beginning the North Carolina return.

Federal Income Tax Total from all Rates. For federal income tax purposes the contribution limitation for cash contributions for tax year 2021 is 100 of an individuals adjusted gross income AGI. The state of north carolina has an income tax rate of 549 percent for the 2018 tax year.

Calculating your North Carolina state income tax is similar to the steps we listed on our Federal. Social Security Compensation Limit. For North Carolina income tax purposes the charitable contribution limitation is 60.

North Carolina has a flat income tax rate of 525 meaning all taxpayers pay this rate regardless of their taxable income or filing status. North carolina payroll taxes north carolina payroll taxes are as easy as a walk along the outer banks. The total bill would be about 6800 about 14 of your taxable income even though youre in the 22 bracket.

The North Carolina bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. Federal income tax and fica tax withholding are mandatory so theres no way around them unless your earnings are very low. This can make filing state taxes in the state relatively simple as even if your salary changes youll be paying the same rate.

95-258 Withholding of Wages an employer may withhold or divert any portion of an employees wages when. Social Security Tax Due. Contribute to Your HSA.

Federal Income Tax Total from all Rates. North Carolinas flat tax rate for 2018 is 549 percent and standard deductions were 8750 if you filed as single and 17500 if you were married and filing jointly. So you will not have to pay taxes on that amount.

The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks. Consider completing a new Form W-4 each year and when your personal or financial situation changes. The fica tax rate for 2018 is 765 percent which is comprised of 62 percent for social security taxes and 145 percent for medicare tax.

Take Home Pay for 2022. North Carolina Income Taxes. Total Federal Income Tax Due.

North Carolina moved to a flat income tax beginning with tax year 2014. For tax year 2021 all taxpayers pay a flat rate of 525. An HSA will also allow you to pay fewer taxes by contributing money to an account that can help you pay for your medical expenses.

Income taxes FICA and court ordered garnishments. Social Security Tax Due. The only other thing you need to worry about is North Carolina State Unemployment Insurance.

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

Calculating State Taxes And Take Home Pay Video Khan Academy

Understanding Your Paycheck Http Www Hfcsd Org Webpages Tnassivera News Cfm Subpage 1077 Student Teaching Teaching Activities Understanding Yourself

Pin By Carolina Stone On Unlock Payroll Template Money Template Printable Tags Template

How To Calculate Payroll Taxes For Your Small Business The Blueprint

Income Tax Calculator 2021 2022 Estimate Return Refund

Paycheck Calculator Take Home Pay Calculator

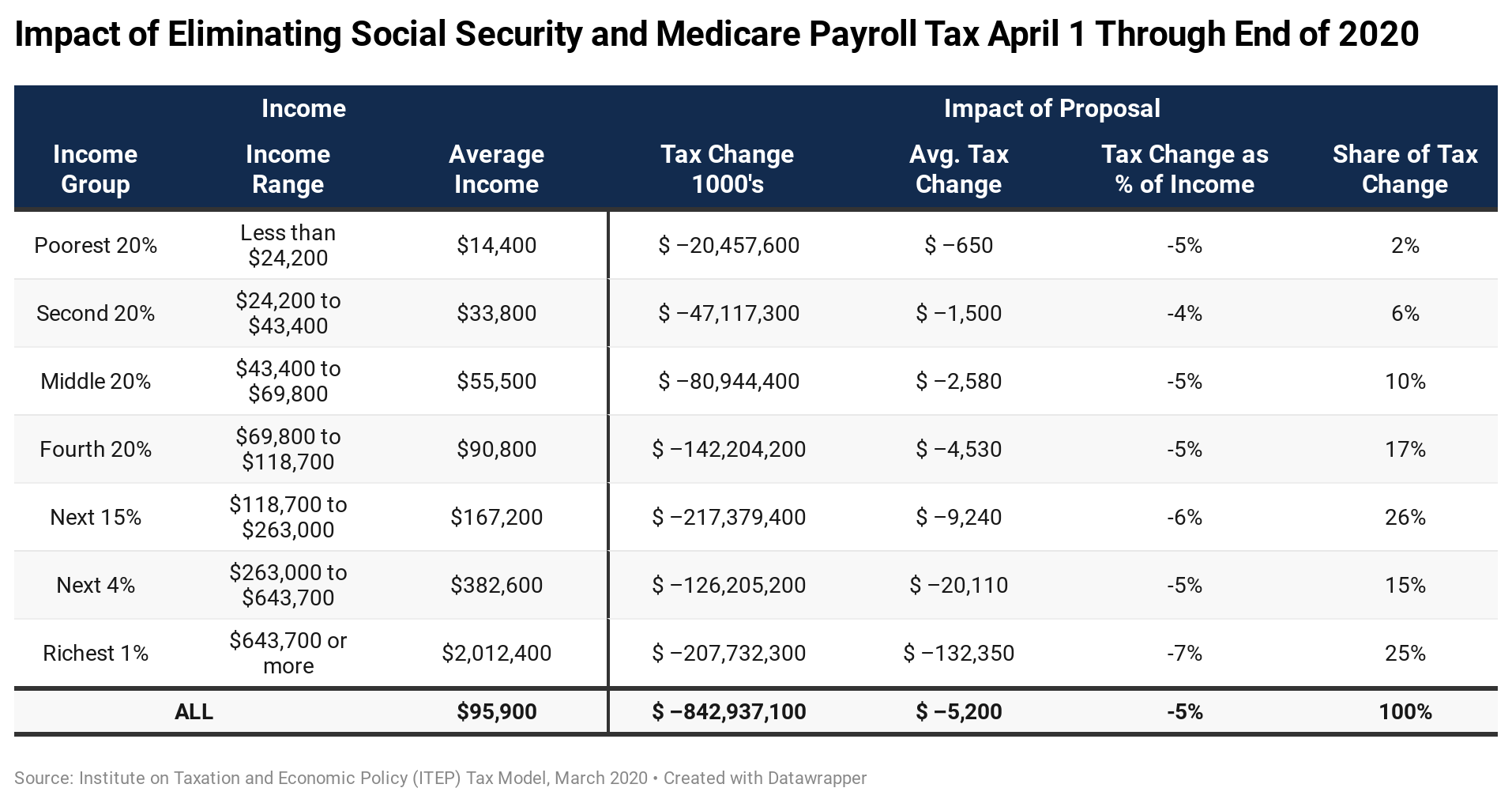

Trump S Proposed Payroll Tax Elimination Itep

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

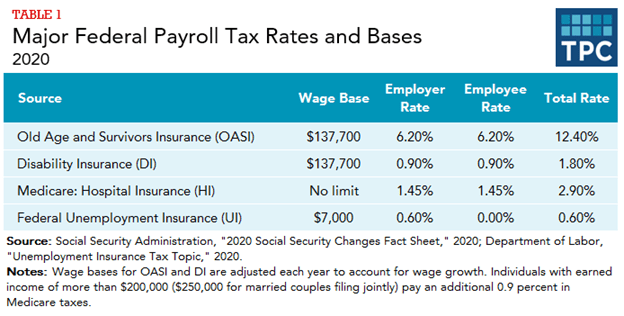

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Government Revenue Taxes Are The Price We Pay For Government

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

See Which States Do Not Have Income Tax Sales Tax Or Taxes On Social Security Start Packing Income Tax Tax Sales Tax

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

How Much Does A Small Business Pay In Taxes

How To Calculate Payroll Taxes For Your Small Business The Blueprint

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)